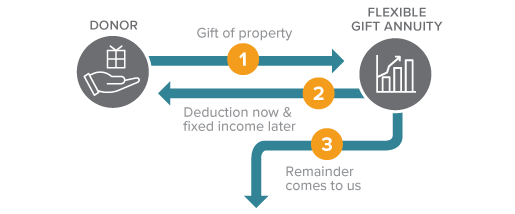

Flexible Gift Annuity

The flexible gift annuity offers the same tax and security benefits that a deferred payment gift annuity provides, but with more options.

How It Works

- You transfer cash or securities to Sarah A. Reed Children's Center. Our suggested minimum gift requirement is $10,000.

- You select a range of dates in the future (window) when you will want Sarah A. Reed Children's Center to begin paying you, or up to two annuitants you name, fixed annuity payments for life.

- During the payment window, you request the start of payments.

- Beneficiaries are recommended to be at least 40 to begin receiving payments and must be at least 65 to fund the gift.

- The remaining balance passes to n/a when the contract ends.

Benefits

- Deferral of payments permits a higher annuity rate and generates a larger charitable deduction. The deduction is calculated based upon the first date in your window on which you could elect to start payments.

- You can target your annuity payments to begin when you need them, such as retirement.

- The longer you elect to defer payments, the higher your payment will be.

Next

- Frequently asked questions on Flexible Gift Annuities

- Contact us so we can assist you through every step.