Charitable Lead Trust

Your hard work has paid off and your business is growing. How can you preserve some of its value for your family?

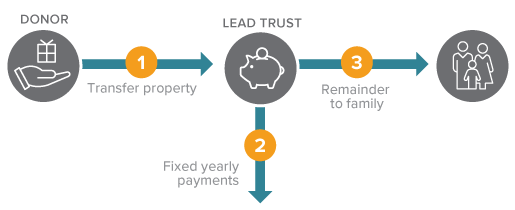

How It Works

- You contribute securities or other appreciated assets to a Charitable Lead Trust. Our suggested minimum gift is $1,000,000.

- The trust makes annual payments to Sarah A. Reed Children's Center for a period of time.

- When the trust terminates, the remaining principal is paid to you or heirs.

Benefits

- Income payments to us for a term reduce the ultimate tax cost of transferring an asset to your heirs.

- The amount and term of the payments to Sarah A. Reed Children's Center can be set so as to reduce or even eliminate transfer taxes due when the principal reverts to your heirs.

- All appreciation that takes place in the trust may go tax-free to the individuals named in your trust.

Next

- Frequently asked questions about Charitable Lead Trusts.

- Contact us so we can assist you through every step.