Charitable Bargain Sale

Make a gift to us while getting cash to meet your obligations, or an assured stream of income for retirement.

How It Works

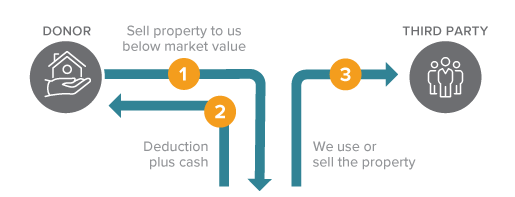

- You sell your residence or other property to Sarah A. Reed Children's Center for a price below the appraised market value—a transaction that is part charitable gift and part sale.

- Sarah A. Reed Children's Center may use the property, but usually elects to sell it and use the proceeds of the sale for the gift purposes you specified.

Benefits

- You receive an immediate income tax deduction for the discount you took from the appraised market value of your property.

- You pay no capital gains tax on the donated portion of the property.

- You can receive payment from us in a lump sum, or in fixed installments.

Next

- Frequently asked questions about Charitable Bargain Sales.

- Contact us so we can assist you through every step.